Background: Operation Midnight Hammer

On 13 June 2025, Israel launched a surprise air offensive against Iran, bombing a series of nuclear and military installations after alleging Tehran was on the verge of nuclear weapons capability. Over the next week, intense exchanges ensued: Iran’s IRGC retaliated with hundreds of rockets and drones targeting Israeli cities, while skirmishes flared across Syria and Lebanon via Iran-aligned militias. The conflict escalated dramatically on 21 June 2025 when US President Donald Trump announced Operation Midnight Hammer, a US air and missile strike against three of Iran’s most critical nuclear facilities. All three sites (Fordow, Natanz, and Isfahan) were integral to Iran’s nuclear fuel cycle and their selection was evidence of a sweeping effort to cripple Iran’s ability to produce weapons-grade material.

Notably, both Fordow and Natanz were under IAEA safeguards at the time of the strikes, meaning they were monitored with cameras, periodic inspections, and seals under the terms of Iran’s Comprehensive Safeguards Agreement. While these facilities had enriched uranium up to 60%, they remained within the bounds of Iran’s NPT obligations, though deeply controversial.

Iran’s immediate response was militarily limited but symbolically charged. In the early hours of 23 June Tehran fired a volley of ballistic missiles at Al Udeid Air Base in Qatar, the largest U.S. base in the Gulf. The attack was preceded by advance warning and ultimately caused no casualties, a fact President Trump pointed to in calling Iran’s response “weak”. Nevertheless, the message was clear: Iran meant to show it could strike American assets in the region. Simultaneously, Iran’s parliament convened an emergency session in which hardline lawmakers voted to authorize closure of the Strait of Hormuz, a move that, if implemented, would choke off 1/5 of global oil shipments. This vote was largely posturing but it demonstrated Iran’s leverage over global energy markets and signaled how far it might go if fighting continued.

By 24 June, intensive behind-the-scenes diplomacy, reportedly involving Oman, Russia, and China, yielded a fragile ceasefire. President Trump announced that Israel and Iran had agreed to pause hostilities, with Israel phasing out airstrikes and Iran halting missile fire. Israeli warplanes stood down later that day, ending ten days of open warfare. The truce, however, remained shaky. Within hours of the ceasefire taking effect, Iranian proxies in Gaza and Lebanon launched isolated rocket salvos, and an Iranian missile strike landed in the Israeli city of Beersheba, causing civilian casualties.

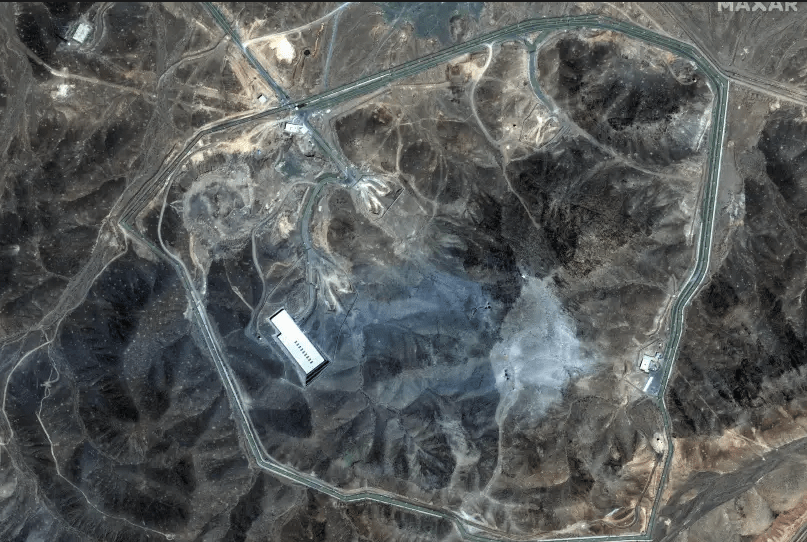

For Iran, the outcome was bittersweet. On one hand, they survived the most concerted US-Israeli military action against it in decades; Iran’s leadership even declared victory once the ceasefire held, with Supreme Leader Ali Khamenei boasting that Iran had “slapped the US in the face” by resisting its demands. On the other hand, the physical damage to Iran’s nuclear program was significant. Post-strike satellite imagery showed heavily damaged buildings at Natanz and Fordow, and Western intelligence assessed that Iran’s enrichment capability had been set back by at least a year or two. US officials characterized the strikes as successful in destroying key infrastructure, while also emphasizing that no strike can destroy the knowledge in Iranian scientists’ heads. As the dust settled, Washington dispatched envoys to rally international support for stricter containment of Iran’s nuclear activities, even as Tehran dug in on its right to peaceful nuclear technology. This set the stage for the strategic implications now unfolding in the region, particularly regarding China’s role and the reactions of Iran’s regional rivals.

Strategic Insights

- The US strikes jeopardize China’s investments in Iran and undercut Beijing’s role as regional mediator. While China condemned the attacks, it continues backing Iran economically an diplomatically. Beijing is expected to avoid direct confrontation while reinforcing ties to Tehran via energy trade, technology transfer, and coordinated diplomatic resistance to US pressure.

- Iran’s nuclear know-how and stockpiles remain intact despite facility damage. If Tehran resumes covert nuclear work, regional rivals like Saudi Arabia, Turkey, and Egypt may accelerate nuclear “hedging” via civilian programs and dual-use technologies. The strikes risk triggering a latent arms race.

- Attacking safeguarding facilities raises global legal and strategic concerns. Iran could reduce IAEA cooperation or even withdraw from the NPT. Regional states now question the value of treaty compliance if it doesn’t shield them from military action.

- The crisis pulls Beijing and Moscow closer to Tehran. Both shielded Iran at the IAEA and could deepen covert cooperation in military tech and trade. China’s Belt and Road Initiative (BRI) ambitions in the region are now tethered to Iran’s resilience and regional stability.

- The strikes boost US-Israel deterrence credibility in the short term, but also embolden Iran’s asymmetric response (ie proxy militias, cyber threats, and maritime disruptions). Gulf states remain diplomatically cautious but are reinforcing ties with U.S. defense structures

Watchlist: Things to Monitor

| Indicator | What It Signals |

|---|---|

| Iran reduces IAEA access (ie expels inspectors or disables cameras) | A move toward clandestine nuclear activity or NPT withdrawal |

| Saudi or Turkish announcements on enrichment or reactor projects | Strategic hedging or quiet proliferation intent |

| Chinese tech transfers or sanctions-evasion trade with Iran | Strengthened Iran-China alignment despite Western pressure |

| Strait of Hormuz naval activity or proxy mobilization | Iranian asymmetric retaliation and escalation risk |

| Gulf states request new US air/missile defense assets | Deepening military alignment amid regional insecurity |

Analyst Comment

From an intelligence perspective, the June 2025 Iran strikes represent a watershed that will reverberate through Middle East geopolitics in the short and mid term. The operation achieved a tactical objective in damaging Iran’s nuclear infrastructure, but it also unleashed a cascade of second-order effects. Chief among them is a likely redoubling of Iran’s determination to obtain a credible deterrent, nuclear or otherwise, to guard against regime-threatening strikes in the future. In turn, this is catalyzing reactions among Iran’s rivals to hedge their bets, potentially ushering the region into a new phase of latent proliferation.

The role of great powers has been pretty illuminating. China’s response, in particular, shows the primacy of interests over ideology in its foreign policy. Beijing’s vocal condemnation of US aggression was expected, but more telling is what China does next. So far, China appears committed to quietly propping up Iran’s economy and defense industrial base to ensure Tehran remains a thorn in Washington’s side and a viable participant in China’s Eurasian economic plans while carefully avoiding overt confrontation with the US or alienation of the Gulf states. This dual-track approach will test China’s diplomatic agility and will be a turning point in its Middle East footprint. Either China will emerge as a more assertive power brokering outcomes in regional conflicts, or it will retreat to the sidelines if costs outweigh gains. Early indicators (evacuation of Chinese nationals and calls for talks) seem to suggest a preference for limiting exposure, but Beijing is certainly learning from this crisis and will adjust its long-term strategy (for example, accelerating efforts to settle oil trades in yuan to reduce vulnerability to US sanctions pressure, as hinted by its increased use of RMB in dealings with Iran).

For the United States and its allies, the near-term requirement is to manage escalation and prevent Iran’s retaliation from sparking a broader war. This will mean hardening bases, improving regional early warning systems and processes, and coordinating closely with partners on contingency responses. Diplomatically, it will be imperative to capitalize on the leverage gained over Iran. If Iran is more isolated or its program set back, now is the time to negotiate firmer limits or at least interim arrangements to remove the most dangerous materials from its soil. The US Special Envoy has already signaled openness to talks focusing on Iran’s enrichment levels and stockpile, which would be a face-saving way for Iran to step back from the nuclear brink in exchange for sanctions relief once it regroups. Whether Iran’s leadership feeling humiliated is willing to engage is uncertain, but the ceasefire offers a narrow window for diplomacy before hardliners on all sides gain the upper hand.

A final note on non-proliferation: the integrity of the global regime is arguably at its most vulnerable point since the North Korean withdrawals of the early 2000s. If the Middle East heads into a proliferation cascade, the credibility of the NPT will suffer worldwide. To counter this, innovative solutions should be pursued. These would include a US-led initiative for a Middle East security guarantee (a nuclear umbrella covering Israel and key Arab states to negate their need for independent arsenals), or a rejuvenated push for regional disarmament talks that include Israel’s capabilities, a topic long taboo but maybe less so in the face of multiple potential nuclear actors emerging.

For intelligence terms, we will be watching for the morning after indicators: Does Iran move materiel to secret sites? Do Saudi Arabia or Turkey suddenly announce new “research” reactors or mining projects? Do China and Russia sign new defense deals with Iran? Each of these will tell us how far the dominoes could fall. As of now, the short-term implications are clear: heightened tensions, hedging, and alignment shifts. The mid-term implications, whether this results in a fundamentally more nuclearized and polarized Middle East, or a sobered return to the negotiating table, will depend on the deftness of diplomacy in the weeks ahead and the willingness of regional actors to step back from the precipice.

Stay tuned for more in-depth analysis on Chinese strategic influence in the Middle East, regional nuclear hedging, diplomatic alignments, and regional deterrence dynamics in a writeup to come.

Additional Reading

https://www.reuters.com/business/energy/chinas-heavy-reliance-iranian-oil-imports-2025-06-24/

https://www.al-monitor.com/originals/2025/05/iran-boosts-highly-enriched-uranium-production-iaea

https://thediplomat.com/2025/06/war-in-iran-chinas-short-and-long-term-strategic-calculations

https://foreignpolicy.com/2025/06/23/iran-china-gulf-states-strait-hormuz

https://mei.edu/publications/special-briefing-israel-strikes-irans-nuclear-program

https://specialeurasia.com/2025/06/24/china-bri-israel-iran-conflict

https://bloomberg.com/graphics/2025-us-strikes-damage-iran-nuclear-sites-satellite-image/

Leave a comment